EFFICENT ENERGY SOLUTIONS

PROJECT FINANCING OPTIONS

There are a number of financial incentives available to help you reduce the cost of a solar project and improve your return on investment. In addition to federal and state incentives, one of the best ways you can improve your solar project’s economics is to monetize the SRECs associated with your solar project. This page provides you with an overview on SRECs and options available to you.

A Power Purchase Agreement (PPA) is a financing arrangement that allows businesses or government agencies to purchase solar electricity with no upfront capital cost. To achieve this, a “host” organization provides unused rooftop, land, or parking lot space as a location for a solar installation. A third party PPA provider pays for the cost of the solar installation and assumes all responsibility for ownership, operation, and maintenance once the solar project is complete.

As the host organization, you enter into an agreement to purchase the electricity produced by the system owned by the PPA provider at a predetermined rate per kilowatt-hour, the same unit of measurement on your standard utility bill.

A well-structured PPA allows you to reduce electricity costs immediately and realize increased savings over time as grid electricity prices rise. Once the PPA contract period expires (typically 15 – 20 years), you can purchase the system at a reduced price, initiate another PPA, or have the solar installation removed.

Benefits Of PPAs

- No initial capital investment since you only pay for the solar electricity that is produced.

- Fixed energy rates. A PPA provides a powerful hedge against volatile electricity prices.

- No responsibility for system operation or maintenance.

- Benefit from solar tax credits, even if your organization has no tax liability to offset. The PPA financier can monetize available tax incentives and pass these savings on to you in the form of a lower PPA rate.

Key PPA Considerations

PPAs provide access to solar electricity without the burden of owning or operating solar equipment by transferring the initial project cost to a PPA provider. Entering a PPA requires a detailed contract and thorough credit review. As a result, choosing a PPA will typically extend a project’s timeline relative to other financing options.

Property Assessed Clean Energy (PACE) is a financing mechanism that enables low-cost, long-term funding for energy efficiency, renewable energy, and water conservation projects. PACE financing is repaid as an assessment on the property’s regular tax bill and is processed the same way as other local public benefit assessments (sidewalks, sewers) have been for decades. Depending on local legislation, PACE can be used for commercial, nonprofit, and residential properties.

PACE is a national initiative, but programs are established locally and tailored to meet regional market needs. State legislation is passed that authorizes municipalities to establish PACE programs, and local governments have developed a variety of program models that have been successfully implemented. Regardless of model, there are several keystones that hold true for every PACE program.

- PACE is voluntary for all parties involved.

- PACE can cover 100% of a project’s hard and soft costs.

- Long financing terms up to 20 years.

- Can be combined with utility, local, and federal incentive programs.

- Energy projects are permanently affixed to a property.

- The PACE assessment is filed with the local municipality as a lien on the property.

Property owners love PACE because they can fund projects with no out-of-pocket costs. Since PACE financing terms extend to 20 years, it’s possible to undertake deep, comprehensive retrofits that have meaningful energy savings and a significant impact on the bottom line. The annual energy savings for a PACE project usually exceeds the annual assessment payment, so property owners are cash flow positive immediately. That means there are increased dollars that can be spent on other capital projects, budgetary expenses, or business expansion.

Local governments love PACE because it’s an Economic Development initiative that lowers the cost of doing business in their community. It encourages new business owners to invest in the area and creates jobs using the local workforce. PACE projects also have a positive impact of air quality, creating healthier, more livable neighborhoods.

The simplest path to financing a solar project is to purchase the system directly. You buy and operate the solar installation which allows you to directly benefit from any available federal, state, and local solar incentives. If you have available capital and tax appetite to absorb tax credits and accelerated depreciation, you may find cash purchases to be the best option.

Benefits Of Cash Purchases

- Faster and more streamlined processing reduces the total time required for a solar installation, allowing you to begin benefiting from clean, solar electricity as quickly as possible.

- Greater potential savings since you avoid third party expenses and interest rates.

- Protection against rising utility rates.

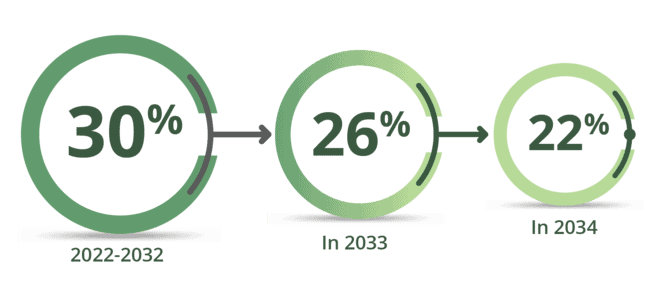

- Access to 100% of available solar incentives. As the system owner, you qualify for a Federal Investment Tax Credit (ITC) worth 30% of the system’s value (through 2032). When you combine this with additional state and local rebates, you can offset the cost of a solar project by 50% or more.

Key Cash Purchase Considerations

Although cash purchases transfer the entire solar installation and all associated benefits directly to you, they also transfer the added responsibility of system operation and maintenance. If total savings are your main concern, it is worth exploring cash purchases as a financing option. However, if you prefer not to devote capital to installing, operating, and maintaining a solar project, consider a PPA or solar lease instead.

A solar lease is a financing option that allows businesses to generate solar electricity with little to no upfront capital investment. Like traditional equipment leases, solar leases provide use of the solar equipment itself in exchange for a monthly lease payment. You benefit from the clean electricity generated from the rented solar installation.

The combination of known lease payments and lower utility bills typically leads to an immediate reduction in electricity costs and provides increased savings over time. At the end of the lease agreement (typically 15 – 20 years), you have the option to purchase the system at a reduced cost, renew the lease, or have the system removed.

Benefits Of Solar Leases

- Little to no initial capital investment.

- Protection against volatile electricity prices.

- Immediate savings on electricity costs since the reduction in grid electricity bills more than offsets your monthly lease payments for the installation.

- Allows you to work with your existing equipment lease financial partners.

Frequently Asked Questions

Solar renewable energy credits (SRECs) are tradable credits that represent all the clean energy benefits of electricity generated from a solar energy system. Each time a solar energy system generates 1,000 kWh (1MWh) of electricity, an SREC is issued which can then be sold or traded separately from the power.

The value of SRECs in a given state is quantified by three major factors:

RPS Compliance Fee Schedules

Compliance fee schedules dictate how much energy suppliers must pay for each SREC they fail to produce or acquire. As a result, SREC prices usually trade at or below the dollar amount of these compliance fees. In some states the fee remains the same dollar amount year over year while in other states, like New Jersey and Ohio, the fee decreases over time which will result in a decrease of the price for SRECs over time.

SREC Supply

SREC supply will increase in the coming years. As solar panel prices fall, solar will become more affordable and more popular. As more solar systems are installed, more SRECs will be available on the market. Additionally, as credit markets continue to improve, more large projects will become financeable and built, resulting in more SRECs. Both of these trends will put downward pressure on SREC prices.

SREC Demand

SREC demand will also increase in the coming years. The demand for SRECs in a given state is set by RPS legislation that determines the overall number of SRECs energy suppliers are required to acquire each year, and this number quickly increases year over year in every state with an RPS. Because SRECs are a compliance commodity, if there are more SRECs supplied than demanded in a given state market, the pricing for excess SRECs will likely be equivalent to pricing seen on voluntary SREC markets, which today trade at $15-$30 per credit.

Because of these factors, SREC values can vary dramatically from state to state. To find out more information about the requirements in your state, please visit www.dsireusa.org.

Most residential and commercial system owners have limited options for selling their SRECs. Energy suppliers are not typically willing to engage directly with small system owners and most system owners have little price leverage. That’s why we have partnered with Sol Systems, the largest SREC aggregator in the country, to provide you with reliable financing solutions that are tailored to fit your needs. Sol Systems is dedicated to making solar more affordable for solar project owners. Sol Systems offers:

- Utility-backed contracts: Sol Systems backs its long-term customer contracts with utility contracts. Unlike brokers who do not have secured counter-party agreements, this ensures that Sol Systems is able to pay guaranteed SREC rates in the long-term.

- Competitive pricing: Sol Systems utilizes its market expertise to secure the best pricing and secure products. Whether a customer selects one of Sol Systems’ long-term SREC purchase agreements or a brokerage solution, they can rest assured that they are getting a quality return for their SRECs.

- Quarterly payments: Sol Systems makes quarterly payments for customers that choose production based payments or the brokerage option.

- Streamlined registration process: When you sign up with Sol Systems, they will manage the registration and certification process with all required regulatory agencies so your system begin producing SRECs promptly.

By choosing one of the following offerings from Sol Systems, you can reduce solar project costs anywhere from 20-40%.

Sol Brokerage is a flexible SREC solution that lets you benefit from the risk-reward of spot-market rates with no effort required. Sol Systems will monitor SREC trading platforms and legislative changes, and will use their market expertise to establish a target price for your SRECs. They will only enter into SREC purchase agreements that achieve the highest market SREC prices. Each quarter, you will receive a payment for each SREC produced by your system. This payment will mirror the weighted average of SREC sales for that quarter less the higher of $5 or a 5% brokerage fee.

Sol Annuity is a long-term solution that gives you guaranteed prices for your SRECs even when spot market prices fall. You will receive a fixed, quarterly payment for each SREC produced over a 3 or 5 year term. For example, a system that produces 1 SREC/quarter at a fixed rate of $325/SREC would generate $6,500 over a 5 year period. You will receive your first payment 4 to 6 months after signing up with Sol Systems. After that, you will receive a quarterly payment in February, May, August, and November based on the number of full SRECs your system produces.

Sol Upfront helps reduce your out of pocket costs by giving you a lump-sum payment that is based on the size (kW) of your system. Once you sign up, Sol Systems will lock the amount of your upfront payment. After your system has been properly registered, you will receive a check within 10 business days, providing you with immediate financing for your solar energy system and eliminating all risk associated with fluctuating markets, legislation, and SREC prices.